What

We Help With

Banking and lending platforms operate under strict regulatory and operational constraints. We support teams across key areas where technical rigor and delivery discipline matter:

Core Platform Modernization

Modernizing banking and lending systems to improve performance and scalability while preserving critical business logic.

Lending & Credit Workflows

Design and delivery of credit, loan origination, underwriting, and servicing systems aligned with regulatory requirements.

System Integrations & Data Flows

Secure integrations across core systems and third-party services to ensure data consistency and operational reliability.

Security, Compliance & Controls

Platforms engineered with strong access controls, auditability, and compliance built in.

Delivery & Engineering Support

Dedicated teams to support long-term platform initiatives and modernization efforts.

Client Case

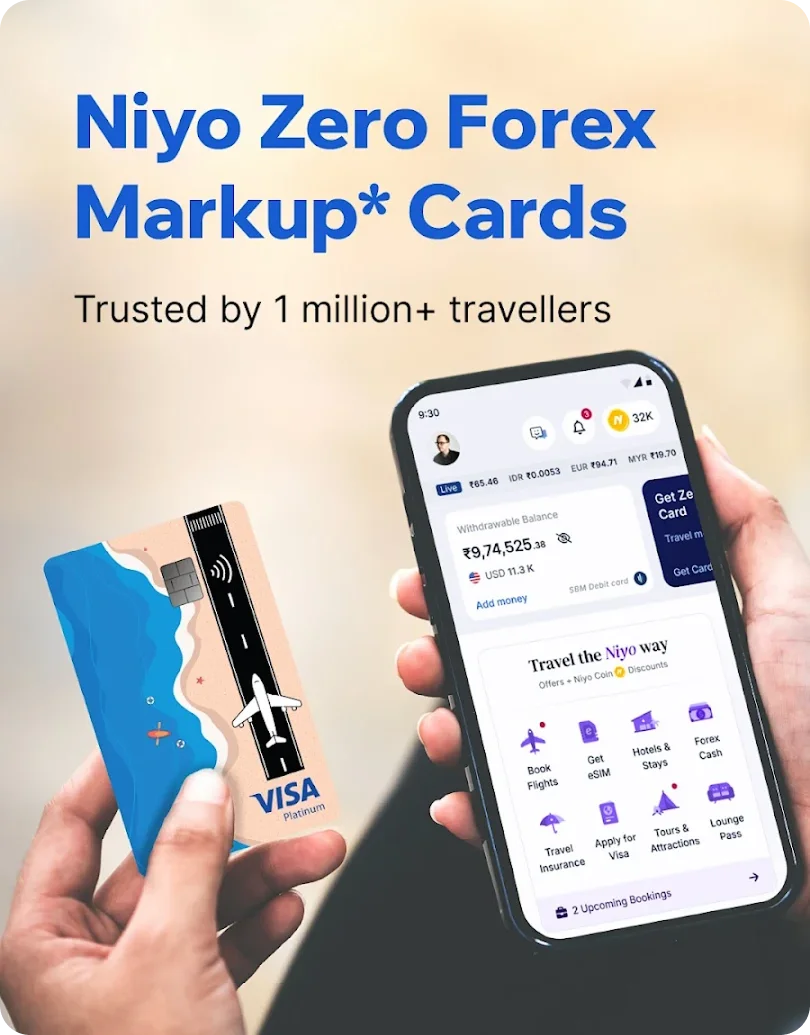

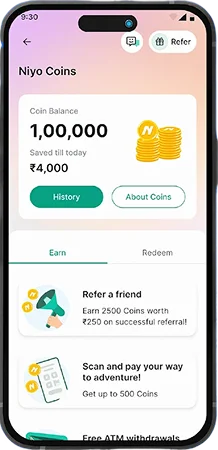

Mobile Banking & Investment Services for Niyo

Enhanced the Niyo mobile platform to unify everyday banking, payments, and investment services into one secure, scalable experience.

What We Delivered:

Delivered as a custom engagement to support secure, integrated retail banking experiences.

Client Case

Digital Trade Finance Platform for M1xchange

Delivered a mobile extension for a regulated TReDS (Trade Receivables Discounting System) platform, enabling end-to-end invoice discounting workflows across suppliers, buyers, financiers, and platform operators.

What We Delivered:

Delivered as a custom engagement supporting regulated trade finance and lending operations.

Client Case

Financial Planning & Reporting Platform

Delivered a web-based financial planning and reporting platform for financial advisors and business owners, replacing spreadsheet-driven processes with structured workflows for clearer planning and decision-making.

What We Delivered:

Delivered as a custom engagement supporting advisor-led financial planning and reporting workflows.

Proven Quality, Consistent Delivery